Bargaining Under Asymmetry – Part 2: What Could (Have) Happen(ed)

Ukraine, the U.S., and the Geopolitical Fallout

Disclaimer: This report is intended solely for academic research and analytical purposes. It has been generated using AI-based analysis and may contain inaccuracies. The objective is to explore economic, geopolitical, and negotiation dynamics rather than to attribute responsibility or reach definitive conclusions. Readers should interpret this analysis as a conceptual framework rather than an authoritative account of events.

🔻 U.S. retrenchment weakened Ukraine's position, forcing it to seek alternative backers.

🔥 Russia escalated militarily, seeing an opportunity to strike before NATO could respond decisively.

🌍 Europe rushed to rearm, fearing U.S. disengagement left them vulnerable.

⚖️ NATO faced a dilemma—escalate involvement or risk signaling weakness.

☢️ The probability of nuclear escalation increased, with the CIA estimating a 50% chance if Russia faced major battlefield losses.

⚡ Outcome: The world entered a precarious balance where every move could tip the scales between deterrence and all-out war.—it was a test of global power dynamics, strategic bargaining, and alliance cohesion.

🔎 How We Break It Down: A Simple 3-Step Approach

To make sense of how the collapse of the Trump-Zelensky rare earths deal could have played out, we use a three-step approach that blends strategic modeling with real-world probabilities. This method helps us explore different scenarios in a clear and structured way, showing the possible paths NATO and Russia could have taken.

1️⃣ Payoff Matrix – NATO vs. Russia: We map out NATO’s possible responses and how Russia might escalate (or not), showing the best and worst-case scenarios.

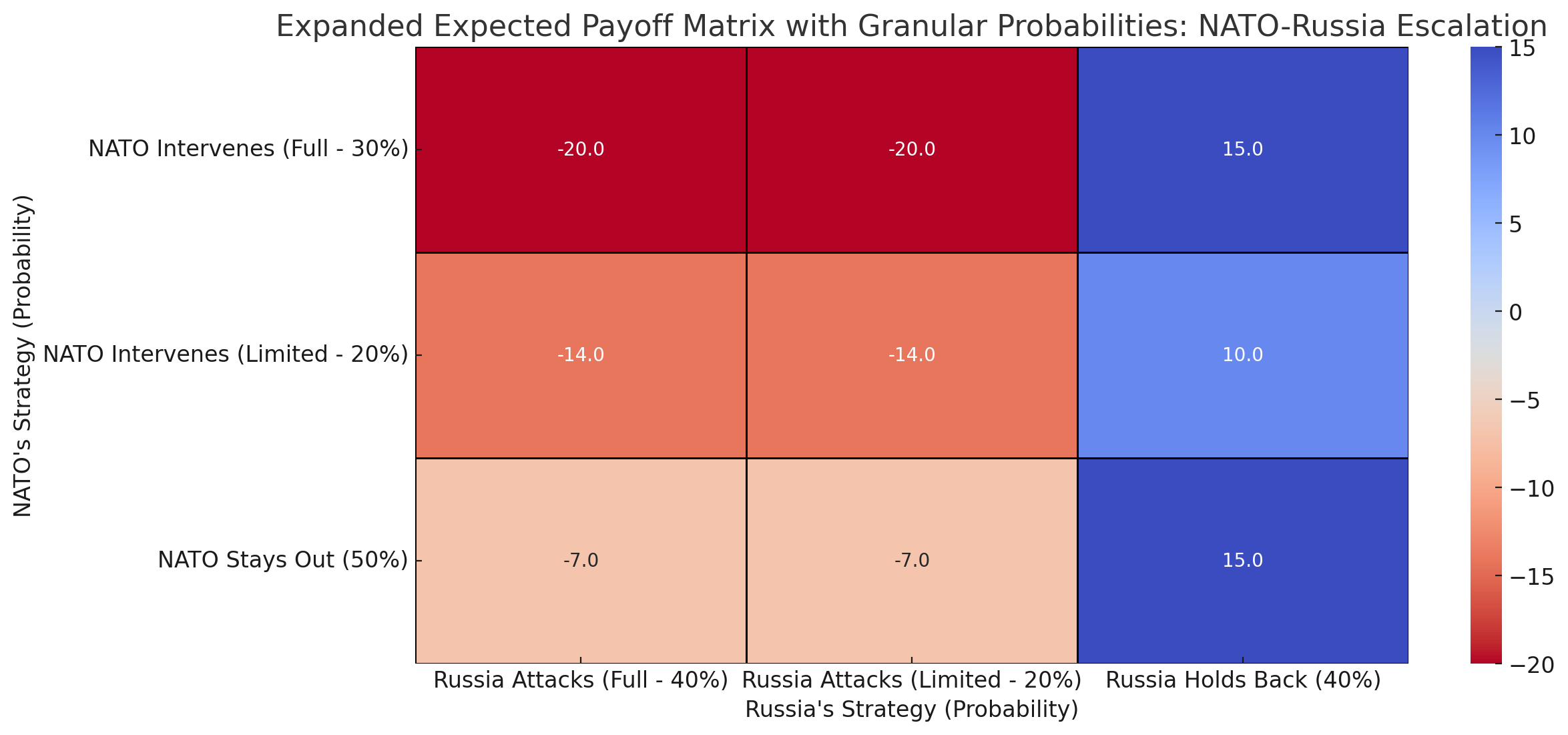

🔽 Click to Expand: Expanded Expected Payoff Matrix – NATO-Russia Escalation

This matrix models NATO’s response choices and Russia’s possible escalations, integrating refined probability distributions.

📊 Key Takeaways:

- If NATO intervenes while Russia attacks, total losses are highest (-40), indicating severe conflict escalation risk.

- If Russia holds back and NATO intervenes, NATO gains while Russia loses influence but avoids war.

- If both Russia and NATO hold back, the best mutual outcome (15) is achieved, suggesting a stalemate or diplomatic off-ramp.

Russia’s strategic options:

- Full-scale invasion (40% probability) → Highest risk of conflict expansion.

- Limited strikes on NATO supply lines (20%) → Intermediate escalation.

- Russia holds back (40%) → Avoids war but seeks leverage.

- NATO’s response scenarios:

- Full military intervention (30%) → Risk of total war.

- Limited intervention (20%) → Controlled deterrence.

- No intervention (50%) → Avoids direct combat but risks Ukrainian collapse.

- Best Outcome (+15 Payoff): NATO remains restrained while Russia avoids escalation.

- Worst Outcome (-20 Payoff): NATO fully intervenes, triggering full-scale Russian retaliation.

Payoffs (Summed for Players):

- The numbers represent relative strategic gains/losses (higher positive values indicate better outcomes for a player; negative values represent losses).

- Negative values for NATO if Russia attacks → Higher risk of war.

- Positive values if NATO deters Russia → Stability benefits all players except Russia.

2️⃣ Monte Carlo Simulation – Risk Probabilities: Using real-world data, we calculate how different choices could shift nuclear risks, economic warfare, and overall escalation.

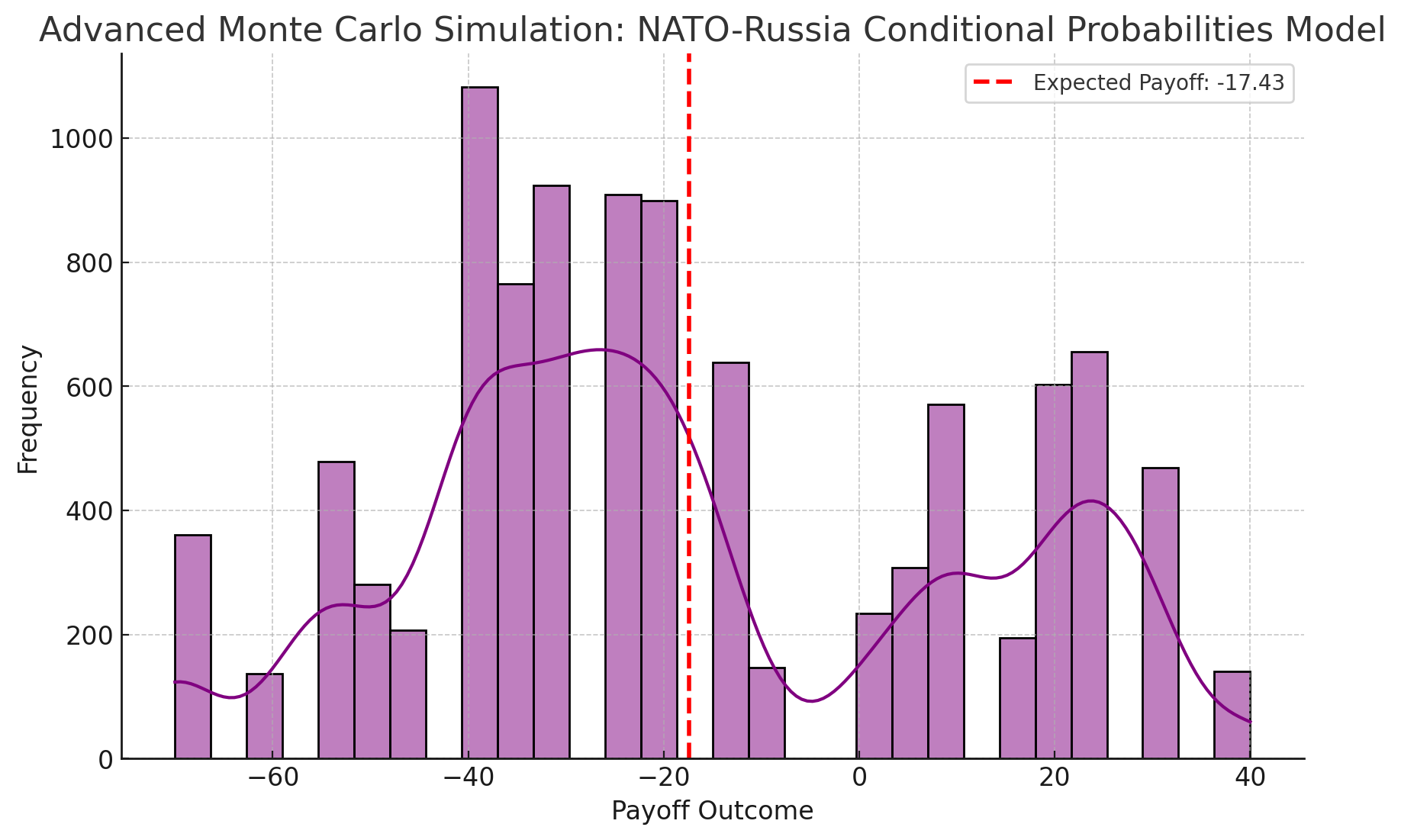

🔽 Click to Expand: Advanced Monte Carlo Simulation – NATO-Russia Conditional Probabilities Model

This refined simulation incorporates deterrence thresholds, nuclear risks, economic warfare, and diplomatic interventions to forecast escalation risks.

📌 Key Insights:

- Expected Payoff: -17.43, indicating a high-risk scenario with potential diplomatic off-ramps.

- Standard Deviation: 27.89, highlighting high volatility in potential escalation pathways.

- Hybrid warfare (15%) emerges as a pivotal tool, meaning cyber and economic tactics are critical in conflict management.

- Nuclear brinkmanship (10%) remains a potential crisis trigger, requiring diplomatic intervention.

What This Tells Us

✔ Full-scale NATO-Russia war is now less likely (25%), but still a serious concern.

✔ Deterrence efforts (20%) and diplomatic breakthroughs (10%) offer pathways to de-escalation.

✔ Hybrid threats (15%) remain a central risk, meaning energy security & cyber defense must be prioritized.

✔ Nuclear brinkmanship (10%) emerges as a potential crisis trigger, requiring back-channel diplomacy.

✔ Economic warfare (20%) provides a high-impact, low-risk alternative to military action.

Strategic Takeaways

- Reinforcing NATO’s deterrence posture continues to shift probability away from war.

- Hybrid warfare (cyber, economic pressure) plays a pivotal role in conflict management.

- Diplomatic intervention (back-channel negotiations via China, India) is still viable (10%) and should be expanded.

- Economic warfare offers a strong alternative to direct military action, with potentially positive payoffs.

- Russia’s nuclear brinkmanship is a key uncertainty that requires cautious escalation management.

3️⃣ Multi-Stage NATO-Russia Simulation: This final step is the heart of our analysis—tracking how Russia and NATO might react in multiple stages of escalation.

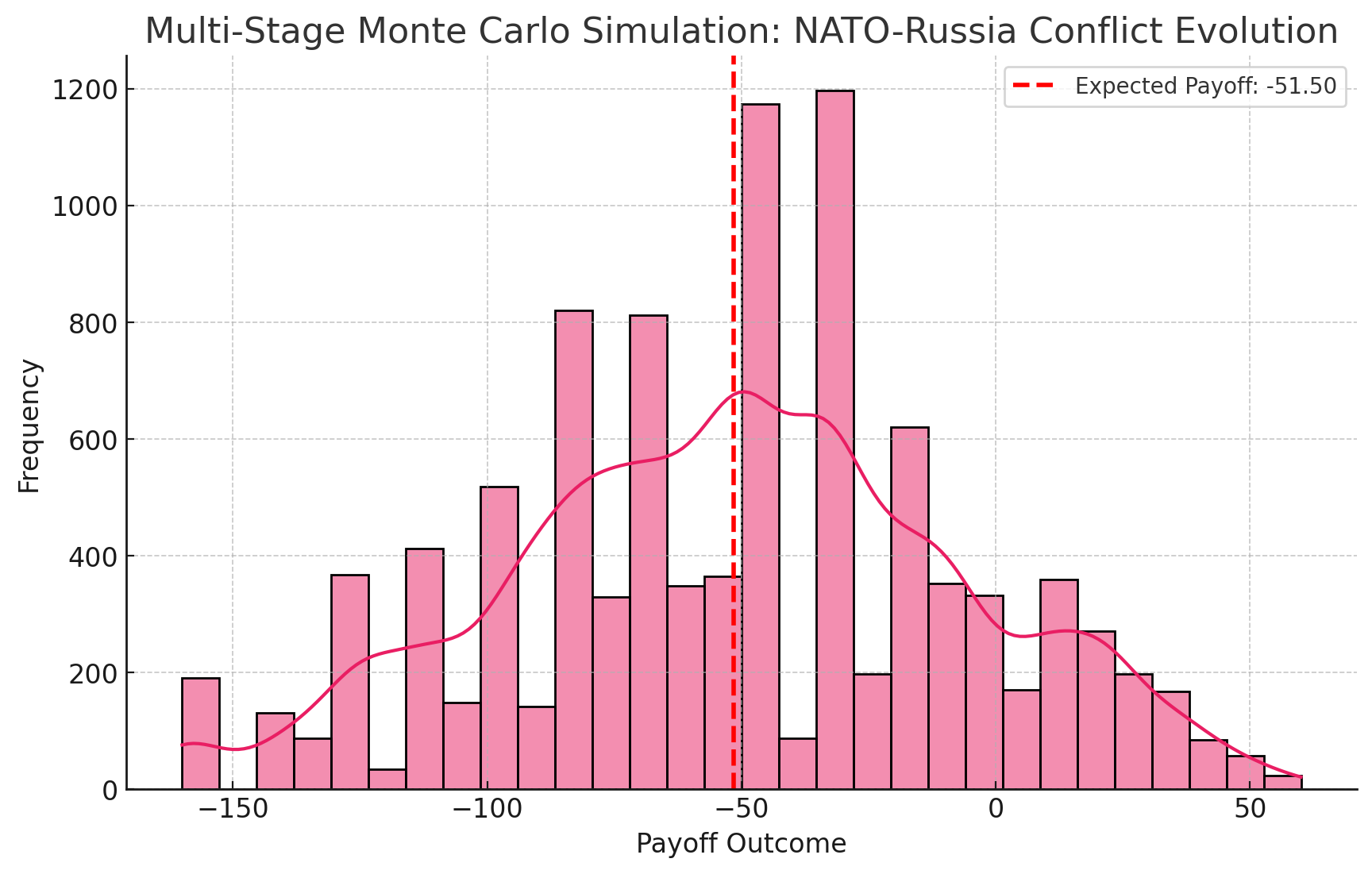

🔽 Click to Expand: Multi-Stage Monte Carlo Simulation – NATO-Russia Conflict Evolution

This model simulates how Russia adjusts its moves based on NATO’s responses, providing the most detailed escalation analysis.

📌 Key Findings:

- Expected Payoff: -51.50, suggesting that escalation risks dominate over de-escalation pathways.

- Standard Deviation: 45.22, reflecting extreme uncertainty and high volatility.

- Expanded Russian Strategies:

- Full-scale Attack (25%) → Highest escalation risk.

- Limited Attack (20%) → Hybrid aggression against NATO supply routes.

- Nuclear Posturing (10%) → Using nuclear threats to force NATO retreat.

- Deterrence Holds (20%) → NATO successfully discourages aggression.

- Diplomatic Resolution (10%) → Pressure from China/India de-escalates tensions.

- Expanded NATO Strategies:

- Full Military Intervention (15%) → Discourages Russia but risks full-scale war.

- Defensive Posture (30%) → Strengthens deterrence without direct engagement.

- Economic Warfare (20%) → Financial sanctions, energy blockades as alternative to combat.

- Diplomatic Engagement (15%) → Avoids military conflict through negotiation.

- Final Stage – NATO’s Response to Russia’s Moves:

- Further Escalation (30%) → War scenario worsens.

- Limited Attacks (20%) → Tensions remain high but short of full-scale war.

- Hybrid Warfare Shift (20%) → Russia pivots to cyber/economic conflict.

- Negotiation Seeking (20%) → Possible de-escalation.

- Nuclear Posturing (10%) → Crisis scenario requiring global intervention.

What This Tells Us

✔ The likelihood of extreme escalation (full NATO-Russia war) is now higher (25-30%).

✔ Deterrence and diplomacy hold some ground but are overshadowed by escalation dynamics.

✔ Hybrid threats (cyberwar, economic pressure) are critical tools in strategic management.

✔ Economic warfare (20%) offers NATO an alternative to direct military engagement.

✔ Nuclear posturing (10%) remains a wild card that requires careful crisis management.

Strategic Takeaways

- Reinforcing NATO deterrence posture is essential to reducing escalation probabilities.

- Hybrid warfare plays a pivotal role in shaping the conflict’s trajectory and must be actively managed.

- Diplomatic efforts should be expanded, with increased pressure from China and India to contain Russian escalation.

- Economic warfare (blockades, financial sanctions) offers an effective alternative to direct military intervention.

- Russia’s nuclear brinkmanship is a key uncertainty, requiring back-channel diplomacy and crisis de-escalation strategies.

⚡ Outcome: This is the dominant scenario for the article. The likelihood of full NATO-Russia war rises to 25-30%, while diplomatic and economic measures remain critical to conflict mitigation.

📌 Ukraine’s Resource Leverage: Ukraine's mineral reserves, estimated at over $12–14 trillion, are a key strategic asset. These deposits—rich in rare earth elements, lithium, and titanium—are essential for global technology and defense industries. Over 50% of these resources are in Russian-occupied territories, making them a focal point in the geopolitical struggle.

See: Ukraine’s mineral map illustrating strategic resource distribution and their impact on negotiations.

- Bargaining Breakdown: President Trump demanded 50% of Ukraine’s future mineral revenues and veto power over mining licenses in exchange for continued U.S. military aid. President Zelensky refused, citing the lack of explicit security guarantees.

- Ukraine’s BATNA (Best Alternative to a Negotiated Agreement): Seeking European military and financial support, appealing to Congress, or, as a last resort, exploring investment from China.

- U.S. Retrenchment: Following the impasse, the Trump administration signaled a freeze on aid, pressuring Ukraine to reconsider.

- European Response: The EU launched an €800 billion "ReArm Europe" defense initiative to bolster Ukraine amid fears of U.S. withdrawal, potentially fast-tracking funds to scale up arms production and deployments.

- Strategic Impact: Russia perceived U.S. disengagement as a window of opportunity for military escalation.

🔽 Click to Expand: Game-Theoretic Analysis of Bargaining Strategies

Bargaining Breakdown: President Trump has insisted that Ukraine “give us something” in return for U.S. aid – notably access to its vast rare-earth and mineral wealth rferl.org politico.com. In early 2025 he demanded that Ukraine hand over 50% of its future mineral revenues and grant the U.S. veto power over licenses, as “payment” for American military support independent.co.uk. President Zelensky balked, calling the terms unfair without ironclad security guarantees for Ukraine’s survival politico.compolitico.com. Game-theoretic bargaining analysis suggests this high-pressure tactic led to a stalemate: Zelensky’s best alternative to a negotiated agreement (BATNA) was to seek other backers rather than cede strategic resources for vague promises. Indeed, Zelensky warned the proposed U.S. deal “does not protect Ukraine” and refused to sign it without concrete security assurances reuters.com russiamatters.org. As the impasse dragged on, Trump’s team canceled a joint press conference and hinted the offer would remain frozen until Kyiv became “ready to have a constructive conversation” reuters.com – a clear signal that the U.S. would suspend or withdraw aid unless Ukraine capitulated.

Ukraine’s Alternatives: Facing U.S. retrenchment, Ukraine would pivot to alternate sources of military and financial support. European allies unveiled an unprecedented €800 billion “ReArm Europe” defense plan to bolster continental security amid fears “Europe can no longer be sure of U.S. protection” reuters.com reuters.com. This includes EU funding for air defenses, missiles, and drones, potentially enabling Europe to supply Ukraine with advanced arms despite a U.S. pullback reuters.com. Europe’s determination to underwrite Ukraine’s fight is evident – EU members provided €150 billion in aid by late 2024, outpacing the $100 billion from Washington russiamatters.org. Private defense firms also see opportunity in scaling up arms production for Ukraine, supported by EU incentives and war-risk insurance. China is another potential, if uneasy, partner: Beijing has economic leverage and in 2023 floated a Ukraine peace plan, but it has mostly given diplomatic support to Russia. In extremis, Ukraine might seek loans or arms from China – though this could come at the cost of political concessions. Overall, Zelensky’s BATNA relies on Europe’s massive rearmament and global partners to fill the void of U.S. aid, allowing him to reject Trump’s ultimatum and still continue resisting Russia.

U.S. Withdrawal and Strategic Shock: President Trump’s decision to pause or halt U.S. military aid would deal a major blow to Ukraine’s battlefield capabilities and morale. Advanced U.S. systems (Patriot missiles, HIMARS rockets, Abrams tanks) and vital intelligence support could be cut off. In our scenario, Trump follows through on his threats: he “paused military aid” to Ukraine in early 2025 after Zelensky rebuffed the minerals deal reuters.com. European leaders were alarmed – seeing this as a collapse of U.S. leadership that emboldens Russia politico.com reuters.com. NATO unity frayed as Washington signaled it would “have Europe” handle Ukraine’s security reuters.com. For Russia, the calculus shifts immediately: the Kremlin openly welcomed signs that “the US is no longer willing to provide free aid to Kyiv” independent.co.uk. A reduced American role validates Moscow’s belief that Western support for Ukraine is fickle and transactional. Thus, Trump’s retrenchment, intended as leverage over Zelensky, also increases Moscow’s expectation that a decisive military solution may now be achievable before Europe fully replaces U.S. support.

- Escalation Calculus: With reduced U.S. deterrence, Russia intensified its military posture, viewing Ukraine’s weakened position as a chance for a decisive offensive.

- Force Mobilization: Satellite imagery and intelligence suggested Russia was massing a 300,000-strong force, preparing for a renewed multi-front invasion.

- Preemptive Strikes on NATO Supply Lines:

- Covert Sabotage: High probability—targeting rail lines and depots through cyber and proxy attacks.

- Limited Overt Strike: Moderate probability—a one-off missile strike near NATO supply hubs to test the alliance's response.

- Widened War: Low probability initially, but increasing as tensions escalate.

- Strategic Outcomes: If NATO remained passive, Russia could achieve a rapid battlefield victory. If NATO intervened, the war risked spiraling into a broader European conflict.

🔽 Click to Expand: Russia’s Strategic Decision Tree and Probabilistic Risk Assessment

Escalation Calculus: Sensing U.S. disengagement, Russia’s leadership might conclude that the risks of a full-scale offensive have diminished. Using game-theoretic modeling, Moscow’s strategy can be seen as a sequential “escalation game.” With American deterrence weakened, Putin could choose to escalate from hybrid war to conventional war to force a decision on Ukraine’s fate while Western resolve is in doubt. Key conditions for this decision include: (1) Ukraine’s forces struggling due to lost U.S. aid (reducing the cost of Russian victory), (2) European rearmament still ramping up (a window before Europe’s military power significantly grows), and (3) a belief that NATO will hesitate to intervene directly without U.S. leadership. If these conditions hold, Russia may mass troops for a renewed multi-front invasion aiming to overwhelm Ukraine’s army and compel Kyiv to capitulate on Moscow’s terms. This aligns with Putin’s long-term goal not just of territorial conquest, but of “triggering the collapse of the Ukrainian state and ruling elite” russiamatters.org– something partial measures have not achieved. In war games analyzed by RAND, Russia is unlikely to accept a stalemate or defeat and will exhaust conventional options if it sees a chance for victory rand.org rand.org. Thus, the probability of Russia launching a full-scale offensive increases sharply once U.S. military intervention is (perceived to be) off the table.

Force Mobilization and Strategy: By Stage 2 of the scenario, Russia mobilizes a massive strike force around Ukraine. Satellite imagery and open-source intel might show divisions of armor and artillery massing in Belarus, Russia’s western regions, and occupied Crimea rferl.org rferl.org. The operational goal: a decapitating blitz to encircle Kyiv and overrun eastern Ukraine, before European aid can compensate for U.S. arms. Russia’s General Staff could dust off plans similar to February 2022, but with adjustments learned from past failures (e.g. improved logistics and command control). A full mobilization might bring 300,000+ troops into theater, with heavy use of airpower and cruise missiles targeting Ukraine’s supply lines to the West. Crucially, Moscow’s doctrine holds open the option of early escalation against NATO supply routes if they prove decisive. Russian military thinkers have long emphasized striking an adversary’s logistics and will to fight. If Europe doubles down on arming Ukraine, Russia may consider limited attacks to interdict the flow of weapons from Poland, Romania, or the Baltics.

Preemptive Strikes on European Supply Lines: The gravest risk in Stage 2 is Russia expanding the war beyond Ukraine’s borders to cut off Western arms deliveries. This could take several forms, each carrying different probabilities and consequences:

- Covert Sabotage: High likelihood. Russia might target rail lines, depots, or convoys in Poland or Slovakia through deniable means (cyber sabotage of rail signaling, proxy sabotage teams). Such attacks could disrupt arms shipments while offering Moscow plausible deniability to avoid outright NATO retaliation. European intelligence agencies have warned that Russian “acts of sabotage against Western targets may eventually prompt NATO to consider Article 5” if they persiststraitstimes.com. The stealthier the attack, the more Russia can slow supplies without triggering a unified NATO military response.

- Limited Overt Strike: Moderate likelihood. In a bolder move, Russia could launch a one-off missile or airstrike on a logistics hub just over the border – for example, hitting a supply convoy inside Poland near a border crossing. The probability of this rises if the Kremlin believes NATO is too divided (or U.S. leadership too reluctant) to react militarily. However, even a single Russian missile on NATO soil would be unprecedented and extremely risky. NATO officials have vowed to “defend every inch” of allied territory politifact.com, and such an attack “shall be considered an attack against all” under Article 5 politifact.compolitifact.com. Moscow would be gambling that NATO might deem a brief, contained strike not “of sufficient intensity or duration to trigger Article 5” politifact.com – especially if Russia claims it was accidental. The Politifact analysis of a hypothetical Polish incident notes NATO could choose a measured response if an attack was minor or ambiguouspolitifact.com. Nonetheless, any intentional strike on NATO soil has a high chance (>50% in expert estimations) of prompting a united military response politifact.com politifact.com. Putin would likely reserve this option for a scenario where Russian forces are bogged down and he feels escalating pressure on NATO’s fringes might deter further Western intervention.

- Widened War – Multi-Target Attacks: Low initial likelihood, but rising if the conflict spirals. This would involve Russia conducting open attacks on multiple NATO countries’ infrastructure (e.g. bombing an airbase in Poland and a rail terminal in Romania). Such a flagrant offensive against NATO is highly unlikely unless Russian leadership believes a NATO war is inevitable and chooses to strike first. The probability of direct Russia-NATO conflict becomes significant only in an extended escalation: for instance, if a limited strike provoked a NATO military response (air patrols, intercepts) that then led to exchanges of fire. Analysts caution about “distinct danger of accidental escalation” – a stray Russian missile or miscalculation could rapidly turn into “a real exchange of artillery across the border” even if neither side initially intended a broader war politifact.com. In summary, while Russia will initially calibrate any attacks on European supply lines to avoid full NATO retaliation, the pathways to open war exist if tit-for-tat strikes begin. A Monte Carlo simulation of conflict scenarios might show a low (<10%) chance of immediate NATO-Russia war at the first strike, but escalating odds with each retaliatory cycle thereafter.

Direct Russian-European Clash Odds: If Russia limits its actions to Ukraine, NATO is likely to stay out militarily. But the scenario posits Russia intentionally or unintentionally drawing Europeans into combat. The chance of a direct air or naval clash – e.g. Russian fighters buzzing too close to NATO aircraft or a naval incident in the Black Sea – increases as Russia prosecutes the war more aggressively. Cyber attacks on European targets (power grids, command networks) are almost certain in a major war, as Moscow tries to sow chaos and deter Europe. NATO has declared that large-scale cyber attacks “could trigger Article 5” as well straitstimes.com, though in practice the threshold remains uncertain. Overall, by the end of Stage 2, the conflict stands on a knife’s edge: Russia’s invasion might be succeeding against Ukraine, but its increasingly desperate measures to stop Western aid raise the probability of NATO involvement from near-zero to a significant risk. Even if NATO’s entry isn’t immediate, European powers will be moving to the next stage – deeper intervention short of full alliance activation.

📌 Nuclear Risk Assessment: The CIA reportedly assessed a 50% probability that Russia could resort to tactical nuclear weapons if facing a significant battlefield defeat. This risk calculation influenced NATO’s response strategies, reinforcing the necessity of clear deterrence signals and crisis management mechanisms.

- Europe Fills the Void: European nations rallied behind Ukraine, accelerating defense spending and military aid.

- NATO Article 5 Activation Scenarios:

- Direct Russian Strike on NATO Territory: Near 100% likelihood of full alliance response.

- Accidental Border Skirmish: ~30% likelihood of Article 5 invocation.

- Attack on European Forces in Ukraine: Unclear legal threshold but politically escalatory.

🔽 Click to Expand: NATO’s Strategic Options and Red Line Scenarios

Europe Fills the Void: Confronted with both U.S. withdrawal and Russia’s escalating aggression, European nations would rally to Ukraine’s defense in unprecedented ways. The European Union’s €800 billion rearmament initiative (announced March 2025) is central to this effort reuters.com reuters.com. Under what Commission President von der Leyen calls “an era of rearmament” reuters.com, EU members are boosting defense budgets to acquire advanced weapons, build industrial capacity, and coordinate deployments. For example, Poland and the Baltics – directly threatened by Russia’s offensive – might move troops and air defenses toward the front lines in Eastern Poland and Romania to protect supply corridors. Germany and France, after decades of underinvestment, have pledged major increases in military spending reuters.com. Europe’s goal is to create a post-U.S. security backbone for NATO, so that even if Washington is hesitant, Russia is deterred by European force. European NATO members spent €326 billion on defense in 2024 reuters.com, and plan to raise this significantly. According to the EU Defense Agency, even a 1.5% of GDP increase on average could unlock €650 billion over four years for defense reuters.com. Europe’s new unity of purpose – spurred by Trump’s perceived abandonment – means more tanks, jets, ammunition, and training flowing to Ukraine, even as European forces ready themselves for possible direct confrontation. Indeed, leaders explicitly framed support for Ukraine as defense of Europe itself: “security guarantees [for Ukraine] were not charity, but security for the Western alliance” politico.com.

Article 5 Activation Scenarios: The critical question is: at what point do Russia’s actions force NATO’s hand under Article 5? The alliance’s collective-defense clause would come into play if Russia attacks a NATO member’s territory or forces. Several escalation thresholds could trigger Article 5 consideration:

- Deliberate Strike on NATO Territory: If Russia bombs or missiles strike a site in Poland, Romania, or any NATO country – and it’s clearly not accidental – this crosses the red line. NATO Secretary-General Stoltenberg has warned that the alliance will “defend every inch of its territory” against Russian attack apnews.com. In practice, NATO’s North Atlantic Council would convene immediately. While Article 5 is not automatic, consensus to declare an Article 5 situation would be highly likely in this case politifact.com politifact.com. The response, however, need not be all-out war. NATO could initially respond with proportional force – for instance, a limited airstrike on the Russian unit that launched the attack – aiming to punish the breach without widening the war. Still, once blood is spilled on NATO soil, “it’s as clear and direct as that” – all allies are bound to respond politifact.com. Probability: Near 100% that Article 5 is invoked if Russia knowingly attacks a NATO city or base, given the Alliance’s core commitment.

- Accidental or Gray-Zone Incident: A murkier scenario is a stray Russian missile or a border skirmish of uncertain origin. In November 2022, a stray air-defense missile landed in Poland, killing two – initially feared to be a Russian attack. NATO did not invoke Article 5, concluding it was likely a Ukrainian misfire. Experts note that “even a conventional attack might not trigger Article 5 if not of sufficient intensity or deemed accidental” politifact.com. NATO might respond with an Article 4 consultation (allies confer on threats) instead. However, even an accident can escalate: if Polish or Baltic border guards/fire units return fire thinking they are under attack, real exchange can occur politifact.com. In that case, NATO forces could become engaged and casualties incurred, raising pressure to respond in kind. Probability: Moderate – perhaps ~30% – that an ambiguous incident could lead to Article 5 if it spirals beyond a one-off event. NATO would likely seek to verify intent before declaring a collective defense scenario.

- Russian Attack on European Forces in Ukraine: Suppose European nations, acting outside formal NATO command, send a “coalition of the willing” force into Western Ukraine (e.g. to create a humanitarian safe zone or guard supply routes). If Russia strikes these forces on Ukrainian soil, the legal invocation of Article 5 is debatable (since the attack wasn’t on NATO soil). However, politically it could be seen as an attack on NATO nationals. This scenario might mirror Cold War proxy war dynamics. Likely NATO would strongly warn Russia and possibly respond with air cover for its forces, without an Article 5 declaration to keep the war “out of area.” Over time though, any sustained Russian campaign killing European troops could blur into a de facto NATO-Russia war.

In any case, NATO’s response will try to balance unity and escalation control. The treaty allows each ally to decide what “action it deems necessary” in response politifact.com politifact.com. This flexibility means even if Article 5 is invoked, not every member must declare war – some could focus on cyber or economic retaliation politifact.com. President Trump, notably, might argue for minimal U.S. military action even in an Article 5 case (as discussed below in Section 4). The key for NATO is maintaining solidarity; a lukewarm or divided response could be catastrophic for the alliance’s credibility. This is why European leaders are intensely preparing. They recognize that NATO’s unity vs. European autonomy may be tested if Trump’s America does not fully back collective defense.

NATO Unity vs. Trump’s Reluctance: Under President Trump, an unusual scenario could arise – Europe (and Canada, etc.) vote to invoke Article 5, but the U.S. president is reluctant to contribute U.S. forces. Trump has a history of questioning Article 5 obligations, once suggesting America might not defend allies who “failed to spend enough on defence,” even musing that he “wouldn’t mind if Russia attacked them” in such cases devdiscourse.com devdiscourse.com. In 2024, his comments triggered a storm by implying he might let Russia “do whatever the hell they want” to delinquent NATO members indy100.com. If Russia’s attacks are focused on Eastern Europe (who have met NATO spending targets in large part), Trump’s rationale for non-action is weaker – but his “America First” instinct might still incline him to avoid a war. In a NATO Council meeting to consider Article 5, it’s conceivable Trump could veto consensus or stall, effectively paralyzing NATO’s response. European allies are already planning for this contingency: Germany’s incoming Chancellor Merz openly questioned whether “NATO will remain in its current form” and advocated talks with France and Britain on a European nuclear protection arrangementreuters.com. France’s President Macron responded that he is “open to discussing extending the protection of France’s nuclear arsenal to European partners” reuters.com – essentially a European deterrent backstop if U.S. guarantees waver. This marks a profound shift: Europe preparing to act autonomously within or even outside NATO if needed. Should Trump refuse to honor Article 5, NATO’s core would be shaken, but France, Britain, and willing others might form an ad hoc coalition to confront Russia. This “two-tier NATO” outcome would be dire for transatlantic security; thus European policymakers hope to avoid it through intensive diplomacy with Washington. Still, given Trump’s prior stance, they are clearly bracing for the possibility that Europe may have to fight with diminished U.S. help – a scenario explored further in Section 6.

- U.S.A.’s Strategic Dilemma:

- Full U.S. Commitment: Least likely, given Trump’s skepticism of NATO.

- Limited Response & Diplomacy: Most probable—a push for negotiations while avoiding military entanglement.

- Gradual/Delayed Intervention: Possible if Russian aggression escalates uncontrollably.

- Nuclear Deterrence and Stability: As conventional escalation increased, the risk of nuclear brinkmanship grew, requiring crisis management mechanisms.

🔽 Click to Expand: U.S. Role in a NATO-Russia Conflict Under President Trump

President Trump’s Strategic Dilemma: As a NATO-Russia war looms, President Trump faces a stark choice between his isolationist impulses and the weight of U.S. treaty commitments. Three broad U.S. strategic options present themselves:

- Full Military Commitment: Trump could decide to honor NATO obligations and deploy overwhelming U.S. force to Europe to deter Russia. This would mean rushing U.S. Army brigades and Air Force squadrons to Poland, ordering the U.S. Navy to secure European waters, and possibly establishing a no-fly zone over parts of NATO territory bordering Ukraine. Such a response aligns with traditional U.S. strategy (“defend every inch” politifact.com) and would greatly strengthen NATO’s hand. However, given Trump’s record, this seems the least likely path. He has consistently downplayed U.S. global policing and shown reluctance to risk American lives unless clear U.S. interests (or profits) are at stake. Indeed, his initial reaction to conflict might be to seek a deal with Putin to quickly end hostilities on favorable terms (even if that sacrifices Ukrainian interests). Only if Russia blatantly attacked a NATO member and domestic pressure became overwhelming might Trump commit U.S. forces without reservation.

- Diplomatic or Limited Response: More plausibly, Trump would pursue a “deal-maker” approach. He could urgently call summits with Putin, offering concessions (e.g. recognition of Russian gains in Ukraine) in exchange for halting the war. He might also lean on European allies to accept a ceasefire that freezes the conflict, rather than escalate militarily. If pressed to respond, Trump might favor economic and hybrid warfare measures: expanded sanctions on Russia, cyber operations, and providing intelligence support – but stopping short of engaging Russian forces directly. Essentially, Trump could seek a face-saving way out: contain Russia through pressure and negotiation rather than battlefield confrontation. This approach risks appearing weak and could undermine NATO’s deterrence (emboldening Putin’s belief that the U.S. will blink first). It also may not satisfy Congress or allies if NATO territory was attacked.

- Gradual/Delayed Intervention: A third scenario is that Trump initially hesitates (perhaps trying the diplomatic track), but as the conflict worsens – say Russia persists in attacking NATO supply lines or seizes a chunk of Ukraine – he eventually authorizes U.S. military involvement in a limited fashion. This delayed intervention could mean the U.S. enters the war later than allies, perhaps deploying air defense units to protect Poland or using the U.S. Air Force to enforce certain red lines (like no Russian flights west of a certain longitude). The consequence of delay is a loss of strategic initiative: Russia might achieve significant gains or shatter allied defenses before U.S. power comes into play, making the eventual intervention costlier. Additionally, a delayed U.S. entry could cause political rifts – allies might resent the initial absence, and Russia might miscalculate U.S. resolve entirely.

In all cases, Trump’s personal leadership style – impulsive, deal-focused, skeptical of alliances – would heavily influence U.S. actions. Internally, he would face pressure from the Pentagon and Congress: even many Republicans (especially in the Senate) strongly support NATO and would urge robust action if NATO is under attack. But there is also an “America First” wing that would back Trump in minimizing U.S. involvement. This domestic tug-of-war could slow decision-making at critical moments (a dangerous prospect in a fast-moving conflict). Ultimately, the U.S. stance under Trump is a wild card: the credibility of NATO’s response may hinge on whether the President can be convinced that U.S. interests – and his own political fortunes – depend on standing up to Russian aggression rather than striking a quick bargain.

Nuclear Deterrence and Stability: Throughout the escalation, the shadow of nuclear weapons looms large. Both NATO (via the U.S., UK, and France) and Russia have nuclear arsenals, and the war’s trajectory would be constrained by each side’s desire to avoid crossing the nuclear threshold. The critical question is: at what point might Russia consider using tactical nuclear weapons in Ukraine or even against NATO targets? Russian nuclear doctrine allows first use if the state’s existence is threatened or in response to large-scale aggression with conventional weapons that exceed its capacity to defend russiamatters.org thebulletin.org. In practical terms, if Russia were facing a decisive military defeat – for instance, if NATO forces directly entered the war and started rolling back Russian gains – Putin might see a limited nuclear strike as his only hope to “escalate to de-escalate,” shocking the West into backing off chathamhouse.org chathamhouse.org. U.S. intelligence during the Ukraine war indicated this risk was low while conflict was limited to Ukraine, but not zero. In fact, CIA estimates in fall 2022 (when Russian forces were in retreat) reportedly put the chance of Russian nuclear use as high as 50% if Putin faced imminent defeat russiamatters.org. More recently, U.S. officials like Antony Blinken expressed concern that Putin had at least “considered the nuclear option,” warning that even a 5% or 15% probability must be taken gravely russiamatters.org.

In our scenario, the likelihood of nuclear use correlates with how directly and existentially Russia’s regime feels threatened. If NATO formally enters the war and Russian forces begin to crumble on the battlefield, that threshold is approached. A tactical nuke on Ukrainian soil (e.g. against an isolated military target or to destroy a logistics hub) is more likely than an immediate strategic attack on NATO cities. Putin would calculate that a demonstration strike – say, a low-yield nuclear explosion over the Black Sea or in a sparsely populated area – might cow the West into halting hostilities without provoking full nuclear retaliation. However, NATO has made clear any nuclear use is unacceptable and would meet a severe response (not necessarily nuclear in return, but potentially massive conventional strikes on Russian forces). The use of a nuclear weapon, even a small “battlefield” device, would break the 77-year taboo and almost certainly trigger global outrage and possibly direct Chinese and Indian pressure on Russia to desist usip.org usip.org. We can roughly assess probabilities: as long as conflict is Russia vs Ukraine alone, nuclear use probability remains very low (<5%). With direct NATO involvement and Russia facing defeat, analysts estimate the risk could rise to 20–25% in a worst-case spiral – truly a frightening number when nuclear war is at stake.

Miscalculation and Safeguards: The only thing more dangerous than deliberate escalation is unintended escalation. History shows many near-misses where US and Soviet forces avoided nuclear war by thin margins. In this scenario, both NATO and Russia would likely implement crisis management measures to reduce the chance of accidents. For instance, the U.S. and Russia might establish a direct presidential hotline (or use the existing deconfliction line used in Syria) to communicate intentions. During the Ukraine conflict, U.S. generals maintained open channels with Russian counterparts to avoid incidents, and similar or expanded links would be vital here. Moreover, NATO could refrain from putting nuclear forces on high alert to avoid signaling imminent use – unless Russia did so first. “Safeguards” include agreed avoidance of certain targets (perhaps an understanding not to strike each other’s territory beyond a certain depth initially). There is also the implicit restraint that both sides know a nuclear exchange means mutual destruction. This kept the Cold War cold and would hopefully impose caution now. Still, the risk of miscalculation – misinterpreting a radar blip as a missile attack, or a local commander overeagerly responding to a provocation – cannot be ignored. The scenario underscores the need for clear communication of red lines. For example, NATO might quietly inform Moscow that any nuclear use in Ukraine will bring NATO fully into the war (conventional devastation of Russian forces), so that Putin understands it won’t scare NATO off – ideally deterring him from going there. Conversely, Russia might warn that attacks deep into Russian territory by NATO aircraft could be seen as existential, thus signaling NATO to limit its strikes. In sum, preserving strategic stability requires constant dialogue even amid fighting. Both sides will try to climb the “escalation ladder” carefully, but as intensity grows, each rung becomes more slippery – making these safeguards and prudent limits absolutely critical to avoid an unthinkable nuclear catastrophe.

- Energy and Supply Chain Shocks: War expansion led to global energy price spikes, supply chain disruptions, and economic contractions across Europe.

- Sanctions and Resource Security: The West intensified sanctions, while Russia retaliated by restricting exports of critical minerals and energy.

- China’s Strategic Calculus: Beijing faced a delicate balancing act—preserving economic ties with the West while discreetly aiding Russia to prevent its collapse. In this hypothetical scenario, China could have expanded economic support through energy deals, indirect military assistance, or diplomatic maneuvering to position itself as a mediator while subtly tilting in Moscow’s favor.

- Domestic Political Constraints:

- U.S.: Internal divisions shaped policy decisions, with isolationist factions opposing deeper engagement.

- Europe: Public sentiment fluctuated between hardline resistance and calls for de-escalation.

🔽 Click to Expand: Economic and Diplomatic Repercussions of a Prolonged Conflict

Energy and Supply Chain Shocks: A widening European war would wreak havoc on global markets and supply chains. Already, Russia’s 2022 invasion of Ukraine caused historic spikes in energy and food prices news.ufl.edu spglobal.com. An outright NATO-Russia conflict would be orders of magnitude more disruptive. Europe could face a severe energy crisis: any remaining Russian gas flows (still reaching Europe via pipelines through Ukraine or Turkey) would halt completely, and oil imports from Russia (already sanctioned in part) would cease entirely. In retaliation for Western sanctions, Russia might sabotage critical infrastructure – for example, targeting LNG import terminals in Europe or undersea cables and pipelines. The sabotage of Nord Stream pipelines in 2022 hinted at the vulnerability of energy links. European governments would likely ration fuel and gas; industries dependent on natural gas (chemicals, fertilizer, manufacturing) could grind to a halt, and winter heating shortages might occur. Global oil prices could skyrocket well above $150/barrel as Russian exports (around 7–8 million barrels/day pre-war) are largely removed from the market and insurance rates for tankers in conflict zones soar spglobal.com. OPEC nations might ramp up production in response, but logistical constraints would cause a lag. The global supply chain impact extends beyond energy. Russia and Ukraine are leading exporters of wheat, corn, and critical minerals (nickel, palladium). War would disrupt Black Sea shipping; insurance costs for cargo vessels could render trade routes impassable. Countries in Africa and the Middle East that rely on grain imports would face shortages and spiking food prices, potentially triggering humanitarian crises far from the battlefield news.ufl.edu. High-tech supply chains would also suffer: Ukraine and Russia supply noble gases (neon, xenon) used in semiconductor fabrication, and Russia is a major source of titanium (important for aerospace) and other metals. Western sanctions combined with war damage would force companies to scramble for alternate suppliers, likely at higher cost. Overall, economists predict that a protracted NATO-Russia war could push Europe into a deep recession (GDP contraction potentially >5%), and significantly drag on the U.S. and global economy through trade disruption and financial market panic spglobal.com economicsobservatory.com.

Sanctions and Resource Security: The conflict would prompt an even more aggressive sanctions regime against Russia. Western nations would move to a “maximum pressure” economic campaign: full embargo on Russian energy, exclusion of any remaining Russian banks from SWIFT, secondary sanctions on countries aiding Russia, and asset freezes on a broader set of Russian industries. Russia, for its part, might retaliate by cutting off exports of critical commodities where it has leverage – for instance, rare earth elements, nuclear fuel (Russia’s Rosatom is a key supplier of nuclear reactor fuel globally), and possibly orchestrating cyber attacks on Western financial systems to inflict economic damage. The war economy would force rapid changes: Europe would accelerate moves to secure alternative gas (from the Middle East, U.S. LNG) and fast-track renewable energy projects to reduce reliance. Defense supply chains would be in overdrive – the €800B European rearmament means factories running 24/7 to produce missiles, shells, vehicles. Supply bottlenecks (like limited production capacity for advanced microelectronics used in weapons) could become acute. Western governments might invoke emergency powers to direct industry (as in COVID times) to prioritize defense needs. Meanwhile, nations like China and India would try to stay out of the line of fire economically, perhaps increasing imports of discounted Russian oil (skirting sanctions) but carefully enough to avoid Western punishment.

China’s Strategic Calculus: Beijing would find itself in a complex position. On one hand, China has a “no-limits partnership” with Moscow and has echoed Russian narratives blaming NATO expansion for the war pbs.org. It has provided economic lifelines to Russia by buying Russian energy and potentially supplying dual-use technologies russiamatters.org. On the other hand, China has significant economic ties with Europe and the U.S., and a full NATO-Russia war threatens global stability which China relies on for growth. In this scenario, China could choose to diplomatically intervene as a crisis mediator – a role it has hinted at by proposing cease-fire frameworks. Beijing might see an opportunity to boost its international stature by brokering a peace (much as it mediated between Saudi Arabia and Iran). However, its credibility in the West is low, and Russia may not listen if it feels victory is within reach. Alternatively, China could quietly ramp up support to Russia to ensure its ally does not fall – for example, providing military drones or ammunition (crossing a line it has so far avoided). U.S. intelligence in early 2023 suggested China was considering sending lethal aid to Russia usip.org; an existential war might push it to do so, especially if the U.S. is distracted and not in a position to sanction China heavily. Yet China would be extremely cautious not to get drawn into a direct conflict. The nightmare scenario for Beijing is a two-front confrontation: a war in Europe that could spill into the use of nukes and a possible conflict in Asia if, say, the U.S. shifts focus and resources to counter China elsewhere. Indeed, China might “exploit Western distraction” by flexing its muscles regionally – for instance, stepping up military pressure on Taiwan while the U.S. is preoccupied. Some analysts theorize that if the U.S. is tied down in a NATO war, China could see a window to act on its long-term goals in the Indo-Pacific. However, doing so would risk a U.S. response and global backlash. More likely, China would sit on the fence: offering Russia economic support to keep it fighting (thus draining Western strength), but simultaneously advocating for de-escalation to avoid uncontrollable outcomes. Notably, reports indicate China has privately warned Russia against nuclear use in Ukraine russiamatters.org – Beijing’s interest is to prevent uncontrolled escalation that could devastate the global economy (and by extension, China’s). Thus, China plays both sides: a quasi-ally to Russia, a cautious observer to the West, and ultimately an opportunist looking out for its own strategic gain in a reordered world if NATO and Russia weaken each other.

Domestic Political Constraints: Within the U.S. and European countries, public opinion and politics will shape how far leaders can go in this conflict. In the United States, Trump’s stance has polarized Congress. Many Democrats (and some Republicans) fiercely oppose any appeasement of Putin and would criticize Trump if he fails to support NATO strongly. Congress could potentially use its powers to force certain actions – for instance, authorizing military aid funding beyond what Trump wants, or in extreme cases, a bipartisan resolution demanding adherence to Article 5. However, Congress cannot direct troop movements; ultimately, Trump as Commander-in-Chief has latitude. If casualties mount or if Trump appears to abandon allies, domestic backlash could be severe. On the flip side, there is war-weariness among portions of the U.S. public after long conflicts in Iraq/Afghanistan. Trump could tap into isolationist sentiment by arguing he’s keeping America out of another world war. Opinion polls would likely swing based on how the conflict unfolds – a Russian attack on NATO might rally Americans to support strong action, whereas a more ambiguous situation could leave them divided. The 2026 midterm elections (in this scenario timeline) could become a referendum on Trump’s foreign policy, pressuring him accordingly.

In Europe, unity against Russia is strong but not unbreakable. Populations have endured economic pain from the Ukraine war (energy prices, inflation), and a larger war would amplify that pain. There could be public fatigue or fear if the conflict drags on or if nuclear threats escalate. Some far-right and far-left political factions (e.g. Le Pen’s party in France, AfD in Germany, or pro-Russian voices in Italy and Hungary) would agitate to stop supporting “an American war” and perhaps push for a negotiated settlement with Russia at almost any cost. However, when Russia directly threatens Europe, we have seen public opinion generally harden in favor of resistance – Poland, Baltics, Nordics have near-unanimous support for defense efforts. Still, if European cities came under attack or economies crashed, political instability could rise. Governments could face no-confidence votes or protests demanding peace. Decision-making on military commitments will thus be a balance: leaders like Macron, Scholz, etc., must keep their public informed and maintain resolve, avoiding panic. One wildcard: if Russia employs weapons of mass destruction (chemical or nuclear), it could either steel public resolve (outrage at Russia) or create panic and demands to de-escalate at any cost. Communication and crisis leadership will be critical domestically for NATO leaders.

Hypothetical Step 4: War-Length Scenarios – How Long Would This Last?

War isn’t just about who wins—it’s about how long it drags on. This final step explores whether the conflict would have been short and decisive, prolonged and costly, or frozen in a long-term standoff.

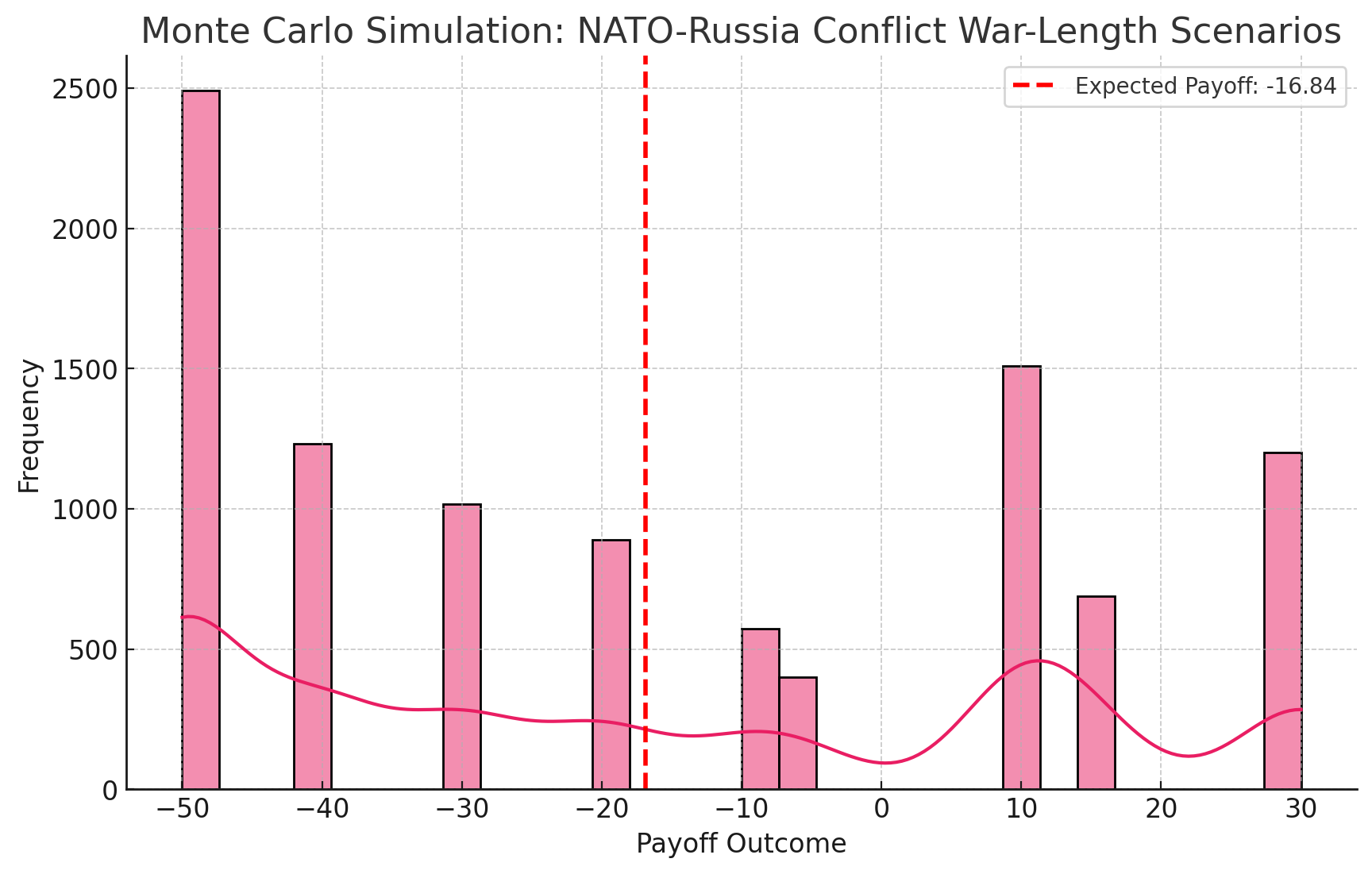

🔽 Click to Expand: War-Length Simulation

Monte Carlo Simulation: NATO-Russia War-Length Scenarios

This expanded multi-stage conflict model now explores war-length variations (short, prolonged, or frozen conflicts), providing deeper strategic insights.

Key Insights from the Model

- Expected Payoff: -16.84 (marked in red)

- This suggests that on average, prolonged or frozen conflicts carry negative strategic consequences, but some scenarios remain more manageable.

- Standard Deviation: 28.44

- A wider spread of possible outcomes, reflecting the unpredictability of long-term geopolitical conflicts.

Refined Probability Model for War-Length

- Short War (30%)

- NATO Victory (40%) → Best-case, decisive victory for NATO forces (+30 payoff).

- Russia Victory (40%) → Russia prevails in a fast conflict (-40 payoff).

- Stalemate (20%) → No clear winner, but limited long-term costs (-10 payoff).

- Prolonged War (50%)

- NATO Victory (30%) → NATO eventually wears down Russia (+10 payoff).

- Russia Victory (50%) → Russia outlasts NATO’s coalition (-50 payoff).

- Stalemate (20%) → A drawn-out war with high costs for both sides (-30 payoff).

- Frozen Conflict (20%)

- NATO Influence Grows (35%) → NATO increases security dominance (+15 payoff).

- Russia Holds Territory (45%) → Russia keeps territorial gains, creating long-term instability (-20 payoff).

- Mutually Weakened (20%) → Both sides suffer economic and political fatigue (-5 payoff).

What This Tells Us

✔ A prolonged war (50% likelihood) is the most probable scenario, with high strategic costs for all players.

✔ A short war (30%) offers decisive resolution but at the risk of an outright NATO or Russian victory.

✔ A frozen conflict (20%) remains possible, but it doesn’t necessarily resolve long-term security tensions.

✔ The worst outcomes occur if Russia wins a prolonged war (-50), while NATO’s best case is a frozen stalemate (+15).

Strategic Takeaways

- NATO should avoid prolonged conflict, as long-term instability favors Russia’s endurance strategy.

- A short, decisive NATO victory (best-case) is achievable, but requires strong, early intervention.

- Diplomatic solutions leading to a frozen conflict should be weighed carefully against long-term strategic losses.

- Economic and hybrid warfare remain key tools in either pressuring Russia or ensuring long-term deterrence.

Scenario 1: Europe Fights Alone

- U.S. remains disengaged, forcing Europe to assume the lead in countering Russia.

- France and the UK extend nuclear deterrence as an alternative security guarantee.

- NATO fractures, with European nations forming an independent defense pact.

Scenario 2: Russia Attacks NATO Supply Lines

- Russia miscalculates by striking NATO logistics hubs, triggering a limited NATO response.

- The conflict escalates through retaliatory cycles, increasing the risk of direct NATO-Russia confrontation.

- De-escalation hinges on crisis diplomacy and controlled military responses.

Scenario 3: U.S. Hesitates, Then Intervenes Late

- Initial U.S. reluctance weakens NATO cohesion and emboldens Russia.

- As European and Ukrainian resistance falters, U.S. eventually commits, but at greater cost.

- Delayed intervention raises the probability of Russian nuclear signaling or tactical strikes.

🔽 Click to Expand: Forward-Looking Scenarios and Risk Assessment

Drawing together the threads, we consider three possible trajectories for the conflict in 2025–2027, assessing risks and outcomes in each:

Scenario 1: Europe Fights Alone – “Europe vs. Russia, with America on the sidelines.” In this scenario, President Trump remains largely disengaged, limiting the U.S. role to arms supplies (if that) and diplomatic noise. European NATO members, led by countries like Poland, the Baltics, Britain, France, and Germany, take on Russia militarily if needed. NATO as a whole may be paralyzed by U.S. ambivalence, so Europe leverages its €800B rearmament to forge an independent coalition. Does France’s nuclear umbrella become Europe’s main deterrent? Quite possibly yes. With U.S. nuclear guarantees in question, President Macron explicitly extends France’s nuclear protection to EU allies reuters.com reuters.com. France (and the UK, which though post-Brexit, remains a NATO member with nuclear arms) would signal to Russia that any attack on Europe could face a French/UK nuclear response if the U.S. declines to act. This is essentially a Europe-only deterrence framework, something unthinkable a few years ago but now actively debated reuters.com reuters.com. Conventional deterrence in this scenario falls on Europe’s ability to mobilize its large, if scattered, forces. The risk here is that Europe’s military, while formidable on paper, lacks the integrated command and enablers (airlift, surveillance, logistics) that the U.S. provides. A RUSI wargame might find that without U.S. combat power, a European coalition could defend NATO territory but struggle to decisively defeat a full-strength Russian invasion of Ukraine warontherocks.com. The war could grind into a prolonged, devastating stalemate on European soil. Politically, NATO might effectively split: an embittered U.S. refusing to fight, accusing Europeans of dragging into war, and Europeans vowing “never again” to rely on Washington. Risk assessment: This scenario is extremely dangerous for European security – heavy casualties and destruction in Europe, a weakened Western Alliance, and the possibility that Russia, while bloodied, remains capable of menacing Europe in the future. However, Europe’s determination and nuclear resolve could eventually force Russia into a costly failure, especially if internal Russian economic collapse happens under sanctions. The long-term result might be a new European Security architecture where the EU (with French nukes) forms a true defense union separate from a broken NATO.

Scenario 2: Russia Attacks NATO Supply Lines – Limited War to All-Out War – In this pathway, Russia miscalculates by conducting limited strikes on NATO territory (e.g. destroying a weapons convoy in Poland). NATO responds in a calibrated way – perhaps a retaliatory strike on the Russian launch battery or a reinforcement of air defenses – trying to prevent escalation into full-scale war. Initially, both sides exercise restraint: Putin may halt at one strike, testing NATO’s reaction; NATO may hold off on invoking Article 5 formally to leave room for de-escalation politifact.com politifact.com. But the situation is incredibly volatile. Any misstep or further provocation can ignite general war. For instance, after the Russian strike, NATO might begin heavily escorting convoys with fighter jets. If those jets are fired upon, NATO could then clear the skies of Russian aircraft operating near NATO borders. One event begets another – soon direct combat could spread along the frontier. NATO’s challenge is to punish Russia enough to deter further attacks but not so much as to push Putin to a corner. They might use non-kinetic means like debilitating cyberattacks on Russian military networks or an economic blockade. Meanwhile, diplomatic channels (perhaps via neutral countries or the UN) would be in overdrive to get Russia to commit to no further NATO-area attacks in exchange for NATO not entering Ukraine directly. This scenario can go one of two ways: either successful containment (a tense ceasefire where Russia stays in Ukraine, NATO stays out, and both refrain from further border violations), or escalation to full war if either side overplays its hand. Preventing full-scale war requires immense discipline – for example, NATO might deliberately not respond to a minor provocation with force, absorbing some damage to keep the peace. Russia too, if it sees NATO’s firm resolve, might step back after an initial strike realizing it achieved nothing but hardening NATO’s stance. Risk assessment: This scenario carries a moderate probability in an uncontrolled conflict because Putin might try a “limited strike” gamble. If managed well, it could end in a fraught de-escalation that avoids World War III. But it’s a tightrope walk – the smallest error could tip the conflict into a general Russia-NATO war, with incalculable consequences. NATO’s best strategy here is clear messaging: draw red lines (e.g. “if you attack NATO territory again, we will strike back decisively”) while offering Putin a face-saving off-ramp (perhaps a new negotiation on arms control or Ukraine’s status once fighting stops). Historically, crises like the Cuban Missile Crisis were resolved by such combinations of firmness and face-saving deals. A similar approach would be needed to defuse this kind of scenario.

Scenario 3: U.S. Hesitates, Then Intervenes Late – In this outcome, President Trump initially avoids deep U.S. involvement, but as the conflict worsens – perhaps Russia scores significant victories or attacks multiple NATO targets – he eventually reverses course and commits U.S. forces. The consequences of delayed intervention are significant. By the time American firepower arrives in full, the strategic situation might be more dire: Ukraine could be on the brink of collapse, or maybe Russian units have dug in along new front lines. U.S. forces may find a more challenging fight, essentially having to claw back territory lost due to earlier inaction. Allied trust in the U.S. will have eroded; European leaders, while welcoming U.S. help at last, will not easily forget that America “hesitated” when Europe was under threat. This could lead to lasting damage to U.S. prestige. Militarily, a late U.S. entry could still turn the tide – America’s dominance in air and naval power would severely pressure Russia. War-game analyses suggest that Russian forces cannot withstand a determined NATO onslaught for long, given NATO’s vast superiority in C4ISR (command, control, communications, computers, intelligence, surveillance, reconnaissance) and precision strike capabilities warontherocks.com. So the war might swing in NATO’s favor once U.S. firepower is fully engaged. However, this very success raises escalation dangers: if Russia starts losing big after the U.S. enters, Putin may consider dramatic escalation (chemical or nuclear weapons) as a last resort. Thus, a delayed U.S. intervention compresses the timeline between NATO conventional superiority and Russian desperation, potentially making the nuclear threshold loom sooner. By contrast, an early robust U.S. show of force might have deterred Russia from certain actions in the first place. Risk assessment: Delayed U.S. involvement leads to higher initial losses for Ukraine/Europe and a riskier climax. The conflict could become more brutal in the interim (with Russia enjoying more freedom before U.S. entry). Politically, however, the eventual NATO victory (should it occur) could restore Western unity post-facto, but with a lesson learned: never again allow divisions to invite aggression. One could foresee, after such a scenario, NATO establishing far clearer protocols and perhaps Europe becoming much more militarily self-reliant to hedge against any future U.S. wavering.

Overall Risk Assessment: The multi-stage escalation we analyzed is not predetermined – at each stage there are decision points that could arrest the slide into wider war. Zelensky’s refusal of Trump’s deal, for instance, was a catalyst here; had he agreed, U.S. support might have continued and Russia deterred (though Ukraine would have effectively paid a steep sovereign price). Likewise, Russia’s choice to escalate is not inevitable; it could be dissuaded if NATO convincingly signals unity despite Trump. The probabilities of the worst-case (NATO-Russia direct war with nuclear use) are still low but not negligible. Experts in late 2024 assessed a “distinct danger of accidental escalation” and perhaps a 10–20% chance of NATO-Russia clashes if the Ukraine war expanded politifact.com politifact.com. Our scenario increases those odds by positing U.S. withdrawal and a larger Russian offensive – factors that could push the risk higher. Nuclear use remains a last resort; even then, likely confined to tactical strikes if at all, as Putin would hope to avoid provoking his own destruction. But any nuclear use carries an unacceptably high risk of uncontrolled escalation to global nuclear war, which one Swedish analysis put at ~17% in a U.S.-Russia crisis akin to Russian roulette odds english.nv.ua. Such figures underline the imperative to keep the conflict from ever reaching that stage.

Lessons and Strategic Implications

The NATO-Russia escalation scenario outlined is grim but not destiny. At each juncture – U.S.-Ukraine bargaining, Russia’s invasion choice, European response, U.S. involvement, nuclear brinkmanship – there are off-ramps and policy levers to avert the worst outcomes. Deterrence works best when it is unified, credible, and coupled with dialogue. NATO must show strength and cohesion to deter Russian aggression, even in the face of internal political shifts.

Simultaneously, all sides need to keep channels open to prevent miscalculation. A data-driven risk assessment suggests that while a direct NATO-Russia war (and especially nuclear war) remains a low-probability event, the consequences are so catastrophic that extraordinary measures must be taken to keep that probability as close to zero as possible. Here are key lessons synthesized:

🔹 Economic and military security are intertwined – Ukraine’s critical minerals were a bargaining chip, but security guarantees were the decisive factor.

🔹 NATO’s strategic cohesion remains vital – U.S. disengagement fundamentally altered the balance of deterrence and emboldened adversaries.

🔹 Escalation risks must be managed carefully – Missteps in military posturing, hybrid attacks, or nuclear signaling could inadvertently trigger a wider conflict.

🔹 Policy choices shape outcomes – Whether through deterrence, diplomacy, or economic measures, strategic decision-making determines the trajectory of global security.

By heeding the insights from game theory, simulations, and historical precedent, Western policymakers can navigate this perilous scenario – reinforcing deterrence to convince Moscow that escalation means defeat, and pursuing diplomacy to ensure we never pass the point of no return.

🔽 Click to Expand: Policy Recommendations

Given these perilous scenarios, what can be done now (and throughout) to reduce escalation risks and reinforce deterrence?

- Reaffirm NATO’s Unity and Red Lines: Even under a Trump administration, it is crucial that U.S. officials (State, Pentagon) and NATO as an institution quietly communicate to Russia that NATO’s Article 5 is ironclad. Private assurances from Congress and the Pentagon to European allies can help mitigate uncertainty. A clear message – that any attack on NATO territory will prompt a collective defense response – should be delivered to the Kremlin to shape its calculus politifact.com politifact.com. This could deter Russian consideration of strikes on supply lines.

- Bolster European Defense Autonomy (Without Undermining NATO): Europe should accelerate the implementation of its defense investments to be prepared for a greater role. Joint procurement, integrated command exercises, and rapid reaction forces under EU or combined European command can provide a backup if U.S. support falters. France and the UK should deepen nuclear contingency planning with NATO Europe – Macron’s openness to extending France’s nuclear deterrent to allies is a positive step reuters.com. However, this must be balanced with keeping the U.S. engaged; efforts to build European “strategic autonomy” should be framed as strengthening NATO, not replacing it, to avoid triggering U.S. disengagement.

- Strengthen Deterrence in the Gray Zone: NATO should improve resilience against hybrid tactics. This means better cyber defenses (to protect railways, grids), policing against sabotage on critical infrastructure, and perhaps covert counter-sabotage capabilities. Establishing a NATO Hybrid Response Task Force could fill gaps between war and peace, denying Russia easy opportunities to disrupt supply lines without attribution. German intelligence and others have raised alarms on this front straitstimes.com– now is the time to act on those warnings by hardening networks and sharing intel on potential Russian covert ops.

- Maintain Open Channels to Moscow: Paradoxically, intense communication with the adversary is needed as tensions rise. NATO and Russia should maintain a military deconfliction hotline 24/7. Leaders (even Trump and Putin) should meet or at least speak when flashpoints emerge – not as appeasement, but to manage misperceptions. Historical precedent (Cold War hotlines, regular US-Soviet summits) helped prevent war through understanding red lines. The U.S. could quietly revive arms control or risk-reduction dialogues, even amid the conflict, focusing on avoiding incidents and nuclear safety.

- Calibrate Aid to Ukraine to Deter Russia, Not Provoke It Unnecessarily: This is delicate – the West must help Ukraine win, but also avoid giving Russia pretext to widen the war. For example, providing Ukraine the means to defend itself and roll back Russia is legitimate; however, NATO might refrain (at least initially) from sending the longest-range missiles or other systems that could strike deep into Russia’s heartland, to reduce Russian fears of an existential threat. If Ukraine can achieve its aims without directly threatening Moscow or St. Petersburg, the Kremlin is less likely to consider extreme responses. That said, this must be balanced against the moral hazard of letting Russia create escalation blackmail. The West should deny Putin veto power over aid, but can still make prudent choices in pacing and types of weapons.

- Intensify Global Diplomatic Outreach: The U.S. and Europe should work with other major powers, especially China and India, to constrain Russia. As noted, China’s influence might have dissuaded Putin from nuclear escalation russiamatters.org. In a high-risk escalation, a concerted message from Beijing and New Delhi (who value global stability and are nuclear-averse) could pressure Moscow to step back from the brink. Engaging these players early – sharing intelligence on Russian actions violating international norms – could lay the groundwork for them to act as mediators or at least voices urging restraint on Russia.

- Plan for Humanitarian and Refugee Crises: A NATO-Russia clash could produce millions of additional refugees (on top of the 5+ million already from Ukraine). The EU and UN must prepare logistics for mass evacuations (perhaps even from parts of NATO territory if under attack) and emergency aid. Effective humanitarian response can reduce the war’s political destabilization (e.g. uncontrolled refugee flows leading to social unrest). It also signals to Russia that its tactics of targeting civilians won’t break Western unity – instead, the West will absorb and manage the consequences.

- Nuclear Risk Reduction: Finally, to specifically address nuclear dangers, NATO states and Russia could consider a mutual no-first-use understanding (even if not formalized). Short of that, transparency measures – like advance notification of missile tests or movements of nuclear assets – could prevent misinterpreting exercises as actual attacks. Re-establishing arms control treaties (which have all but collapsed in recent years) might be too ambitious during active conflict, but even an informal return to respecting boundaries of the old INF treaty or New START limits would help stability. NATO could also reinforce its missile defenses and early-warning systems to have better confidence against any limited strike, reducing the temptation for Russia to think a small nuke would be a silver bullet.