Imports matter more than exports. Right?

Prologue

I remember my first trade class in Paris. Not the city—though the coincidence felt like a public joke at the time—but a lecture hall with chalk dust in the light and a professor who spoke the way people speak when they intend to rearrange your furniture.

She was the head of the department, and she began the semester with a sentence that sounded, at first, like a provocation designed to wake up a room full of students who had arrived half-believing they already understood the world.

“Imports are what matters most. No?”

She let the question hang there—long enough for the first brave voice to offer the usual catechism about competitiveness and pride, long enough for someone else to object that importing sounded like dependency, long enough for the room to split into teams as if we were debating ethics rather than accounting identities. She didn’t referee. She didn’t correct. She just watched the arguments form, like weather.

I had never thought of trade that way—not as a contest of national virtue, but as a revealed preference: a map of what you need, what you lack, what you cannot make cheaply or safely or at scale, and therefore what you must reach for beyond your borders. I had walked into that class thinking exports were the proof of strength. She was asking whether exports were merely the invoice—and imports the life.

And I believed her. From that day on—thankfully.

Because once you see it, you can’t unsee it. The old slogans don’t disappear, but they begin to sound like superstition: comforting, repetitive, and faintly beside the point.

In my last piece, I ended with a simple question: what, exactly, are we using our money for? This one begins where that question naturally leads. Because once you stop treating money as an achievement and start treating it as a tool, trade looks different: exports become the earning mechanism, and imports become the point.

Introduction

There is a certain kind of sentence that feels true because it is repeated in the tone people use for weather: Exports are good. Imports are bad. It has the moral clarity of a children’s book. We make things, we sell things, we win. We buy things, we “depend,” we lose. The world, in this story, is a scoreboard with two columns, and the righteous column is the one marked “Made Here.”

Then you walk into a supermarket.

Nothing in the produce aisle looks like a moral verdict. Oranges do not announce allegiance. Coffee does not carry a patriotic warning label. Olive oil does not arrive with a speech about industrial strategy. It just sits there, quietly converting distance into breakfast. If you want to know what a society values, you can read its laws and its election posters. If you want to know what it actually consumes, you can read its imports.

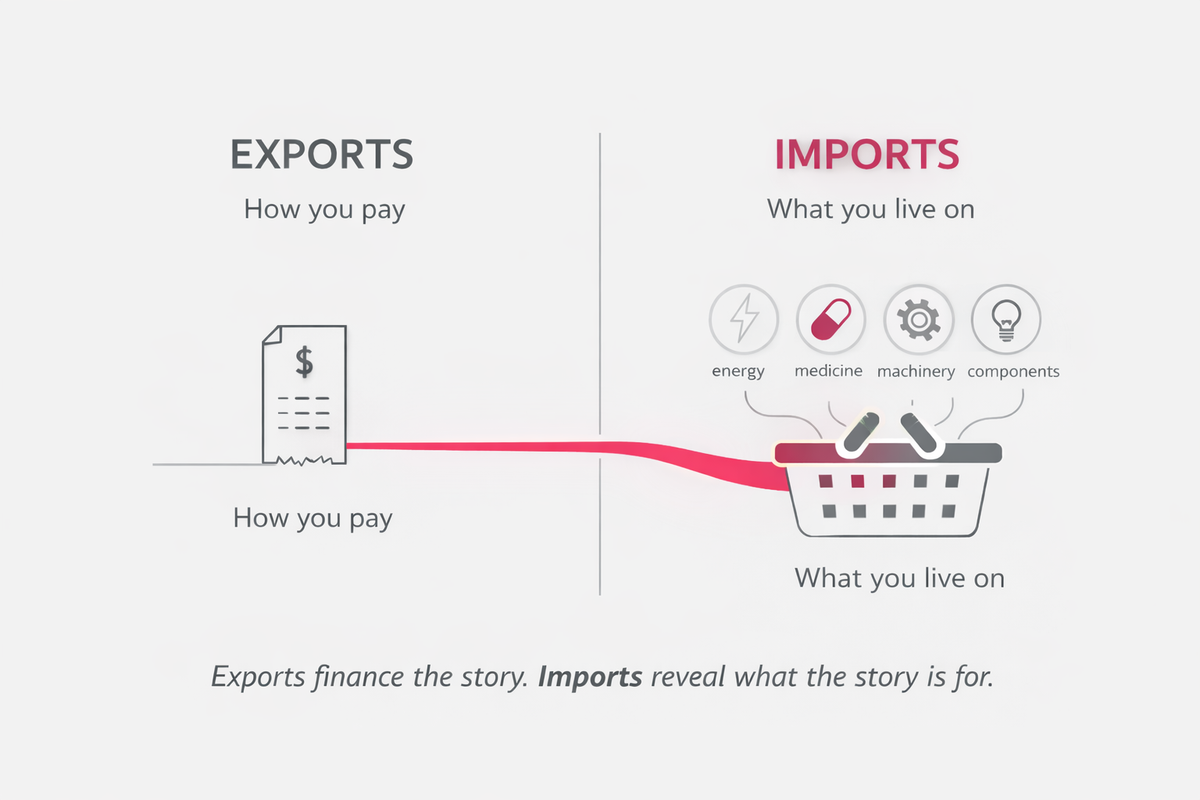

The uncomfortable truth is that imports are not the “leak.” Imports are the point. Exports are one of the ways we pay for what we truly want: energy that keeps the lights on, medicines that extend life, machines that multiply labor, components that make modern production possible, and the thousand small conveniences that add up to a standard of living.

This is the part of trade talk that gets strangely evasive. Politicians celebrate exports as if shipping containers were trophies. Imports get discussed like a vice. Yet the only reason anyone cares about money at all is that it can be exchanged for things. Imports are where that exchange becomes real.

So yes: imports matter more than exports. Or do they?

That question is not a trick. It is an invitation to think about trade the way it actually functions: as a system for acquiring what you do not have, with the least friction possible, in the most stable way possible, under the worst conditions you can imagine.

Exports are visible. They come with ribbon cuttings. They can be pictured. A minister can stand in front of a factory and point at a product and say, “This is success.” Imports are not as photogenic. They arrive at ports at night, move through warehouses, dissolve into the background of daily life, and reappear only when they are missing.

Because exports are visible, we tend to mistake them for the purpose of trade. But exports are, in a plain sense, work. They are effort converted into purchasing power. They are the thing you do so you can afford the thing you want.

You can run this logic at household scale without any ideology. No one confuses a salary with a life. Your job is not your dinner. Your job is how you pay for dinner. A healthy life is not measured by how many invoices you issued. It is measured by what you could afford, what you could access, and how resilient that access was when things went wrong.

At national scale, we sentimentalize the paycheck and moralize the grocery list. That is how “imports bad” survives.

The honest version of the slogan is less satisfying but much more accurate:

Exports are financing. Imports are consumption and capability.

Which brings us to the first way imports “matter more.”

A society’s standard of living is the set of goods and services it can reliably access, at tolerable prices, without constant drama. Some of that is produced domestically. Some of it is not. And in modern economies, “not” is often the rule.

Even countries that pride themselves on manufacturing are deeply reliant on imported inputs: specialized machinery, chemicals, advanced components, industrial software, rare materials, and energy. The “national product” is frequently an international assembly of parts, know-how, and logistics, with the passport stamped at the final stage.

When we pretend imports are weakness, we confuse two different questions:

- Are we importing?

- Can we pay for what we import, and do we import the right things?

The first is almost always yes, because the world is not organized for self-sufficiency. The second is where strength or fragility lives.

A nation that can import high-quality energy, medicines, and machinery cheaply is not “losing.” It is upgrading its life. A nation that cannot import essentials without currency crises, shortages, or political bargaining is not “winning.” It is living on a tighter leash than its rhetoric admits.

In other words: import capacity is material freedom.

Imports do not just show what you buy. They show what you cannot yet produce competitively, at scale, at quality, or with security.

Look at the import bill and you can read the economy’s missing organs:

- Large energy imports suggest an energy constraint and vulnerability to price shocks.

- Heavy imports of capital goods can imply an industrial capability gap.

- Persistent imports of medicines can imply weak domestic life-science capacity.

- Heavy food imports can reflect land, water, productivity, or distribution constraints.

- Imports of advanced components can reveal where the frontier really is.

This is why the simplistic anti-import reflex is self-defeating. If imports reveal your gaps, then imports are also your curriculum. They are the clearest, least sentimental signal of what your economy cannot do yet. That signal is valuable. It points directly to where investment and policy might matter, and where slogans are substituting for capability.

The mature response is not “stop importing.” It is to improve what importing looks like: diversify suppliers, secure critical inputs, build buffers, upgrade domestic capacity where it is strategic, and accept interdependence where it is efficient.

A rich country is not a country that imports nothing. It is a country that can import what it needs without fear, and that has the internal strength to substitute when it must.

Exports feel like agency because they are outward. We send goods out. We choose buyers. We “compete.” Imports feel like dependence because they are inward. We need things. We negotiate terms. We worry.

But sovereignty is measured by how well you function under constraint, not by how loudly you talk about self-reliance.

The real test is not whether you can import in calm times. It is whether you can import in ugly times:

- When shipping routes choke.

- When commodity prices spike.

- When a supplier turns political.

- When your currency weakens.

- When interest rates rise and refinancing becomes painful.

- When the world decides, suddenly, that your promises are not as good as they looked.

In those moments, you learn the difference between an export story and an import reality.

A country can be “export strong” and still be “import fragile” if its exports are cyclical, low-margin, politically exposed, or heavily dependent on imported inputs. The export machine keeps running, but the import pipeline becomes the choke point. That is when the glossy narrative meets the physical world.

Import resilience is national breathing room.

And breathing room is power.

To say “imports matter more” is not to sneer at exports. Exports matter because they help finance imports. But the fixation on exports often hides a deeper question: what is your external financing model?

A country can pay for imports through multiple channels:

- goods exports

- services exports

- tourism

- remittances

- income from foreign assets

- foreign direct investment

- official support

- borrowing (for a while)

This is why the moral panic around “trade deficits” is frequently misplaced. A deficit can be a symptom of weakness, or it can be the shadow of a particular position in the global system. The deficit itself does not tell you enough. What matters is the composition and durability of the financing.

Borrowing to fund consumption can be fragile. Borrowing to fund productivity-enhancing investment can be rational. Persistent deficits funded by stable capital inflows might reflect credibility. Deficits funded by short-term hot money can be a trap. The same headline number, two very different realities.

So if the question is “Are imports bad?” the honest answer is: imports are information. They reveal what you need and how you are paying for it. The danger is not importing. The danger is importing essentials through unstable funding, or building a lifestyle that requires a financing structure that cannot survive a shock.

If you want a sharper way to judge an economy than “exports up, good,” try this instead:

What is the country importing into existence?

A healthy import profile tends to look like:

- capital goods and advanced inputs that raise productivity

- diversified suppliers for critical items

- financing that matches the time horizon of what’s being built

- buffers, reserves, and redundancy where the stakes are high

A fragile import profile tends to look like:

- essential imports (energy, food, medicine) with concentrated suppliers

- financing dependent on short-term borrowing

- limited domestic substitutes and thin buffers

- exports that are commoditized, easily replaced, or politically exposed

The point is not that one should worship imports. The point is that imports tell the truth. Exports can flatter. Imports cannot.

Imports tell you:

- what you depend on

- where you are vulnerable

- where you are sophisticated

- what kind of life you are trying to buy

- and whether you can keep buying it under stress

This is a much more honest national mirror than a surplus celebrated like a medal.

They do, in the way oxygen matters more than a marathon medal.

Exports are performance. Imports are the capacity to live well and build capability. Exports are means. Imports are the end. A society does not thrive because it ships out more containers. It thrives because it can reliably bring in what it needs, when it needs it, at a price it can afford, without having to beg, bargain, or panic.

But the “Or do they?” is not decorative. It forces the crucial distinction:

Imports matter more than exports only if you can finance them sustainably.

Otherwise, imports become a stress fracture, and exports become the emergency room.

Which leads to a more adult conclusion than the old slogan:

A strong country is not one that avoids imports.

A strong country is one that can import what matters without fear, because it has:

- productive capacity,

- credible financing,

- diversified access,

- and the strategic ability to substitute when the world turns.

The question, in the end, is not whether we import.

We will.

The question is: what dependencies are we choosing, what capabilities are we neglecting, and what life are we importing into existence?

🔽 Click to Expand: What economists mean by “competitiveness” (Ricardo → modern trade)

1) Ricardo’s comparative advantage: trade is about imports, not virtue

Ricardo’s core move is to separate absolute advantage (who is “best”) from comparative advantage (who is relatively best at something). In that logic, a country doesn’t trade to “win” by exporting; it trades to expand what it can consume by specializing where its opportunity costs are lowest. Imports are not the embarrassment of trade. They are the dividend. Liberty Fund

Why it matters:

If trade raises welfare, it does so because specialization lets you import more (or better) stuff than you could produce alone. Exports are the financing channel; imports are the welfare channel.

2) Krugman’s warning: “competitiveness” becomes dangerous when it’s treated like a national scoreboard

Krugman’s famous critique is that countries are not firms, and the obsession with “beating” other nations via trade balances is often conceptually wrong and politically risky. What matters for living standards is productivity and the capacity to sustain consumption, not “winning” a surplus as if trade were a zero-sum contest. Stern School of Business

Why it matters:

The export fetish is often a category error: it treats trade as a contest, instead of a way to raise real incomes. If you want a practical definition of national strength, “import capacity without crisis” usually tells you more than “export volume with applause.”

3) Porter’s “competitive advantage of nations”: prosperity is created, and clustered, not inherited

Porter reframes competitiveness away from cheap currency and “cost cutting” and toward the micro foundations: innovation, firm rivalry, demanding customers, supplier ecosystems, and industrial clusters. His message is not “export at any cost,” but “build the conditions that make high-value industries possible.” Harvard Business Review

Why it matters:

If you build real capability, your exports improve as a consequence. But the deeper payoff is that your economy can reliably access and afford higher-quality inputs, technologies, and consumption. Competitiveness becomes a capability story, which then shows up on the import side as well (what you can safely depend on, what you can substitute, what you can upgrade).

4) Balassa’s “revealed” comparative advantage: trade flows are a diagnostic tool, not a moral ranking

Balassa’s RCA idea is deceptively simple: instead of arguing about what a country “should” be good at, you look at what its export basket suggests it is relatively specialized in, compared with the world. The point is measurement: trade patterns can reveal underlying structure. Wiley Online Library

Why it matters:

Your import bill is also a diagnostic. It reveals what your economy cannot (yet) produce competitively, at scale, at quality, or with resilience. “Imports are bad” throws away information. A mature strategy reads imports as a map of constraints and upgrading targets.

5) Melitz (firm heterogeneity): trade changes the economy inside the country, not just at the border

Modern trade theory moved from “countries trade” to “firms trade.” In Melitz-style models, exposure to trade reallocates market share toward more productive firms, pushes the least productive to exit, and can raise aggregate productivity through selection and reallocation. IDEAS/RePEc

Why it matters:

Imports are not merely “foreign goods flooding in.” They are also competitive pressure and access to better inputs. In many sectors, imports can raise domestic productivity (and reshape who survives), which is a very different story than the folk tale of national decline.

6) Baldwin and global value chains: exports are often repackaged imports

Baldwin’s “new globalization” argument is that information and communication technology lowered the cost of moving ideas and coordinating production, enabling global value chains. Production fragmented. What shows up as “exports” often contains a large share of imported inputs, embodied in the final good. Asia Global Institute

Why it matters:

Once trade is organized through supply chains, the old slogan “exports good, imports bad” becomes almost meaningless. Imports are frequently the precondition of exporting. If you block imports, you can sabotage your own export machine.

Recent publications:

- Competitiveness is not a trade surplus. It’s the ability to sustain high living standards and strategic autonomy through productivity, resilient financing, and reliable access to essential imports (especially under stress). Stern School of Business

- Exports are one way to pay. Imports are what the payment is for. Stern School of Business

Sources:

Ricardo (1817) – Liberty Fund (Online Library of Liberty):

https://oll.libertyfund.org/titles/ricardo-the-works-and-correspondence-of-david-ricardo-vol-1-principles-of-political-economy-and-taxation

Ricardo text (alternative hosting):

https://www.econlib.org/library/Ricardo/ricP.html

Krugman (1994) – “Competitiveness: A Dangerous Obsession” (full text mirror):

https://pages.stern.nyu.edu/~nroubini/COMPKRUG.HTM

https://cs.uwaterloo.ca/~alopez-o/politics/dangcompet.html

Porter (1990) – HBR article page:

https://hbr.org/1990/03/the-competitive-advantage-of-nations

Porter book citation page (Harvard Business School faculty listing):

https://www.hbs.edu/faculty/Pages/item.aspx?num=189

Balassa (1965) – DOI / journal landing page:

https://onlinelibrary.wiley.com/doi/10.1111/j.1467-9957.1965.tb00050.x

Melitz (2003) – paper metadata (RePEc):

https://ideas.repec.org/a/ecm/emetrp/v71y2003i6p1695-1725.html

Melitz paper PDF (widely circulated copy):

https://web.stanford.edu/~klenow/Melitz.pdf

Baldwin (2012) – Global supply chains paper PDF:

https://www.asiaglobalinstitute.hku.hk/storage/app/media/pdf/richard-baldwin.pdf

Baldwin (2018) – VoxEU explainer on “New Globalisation”:

https://cepr.org/voxeu/blogs-and-reviews/long-view-globalisation-short-new-globalisation-part-5-5

Baldwin book page (Harvard University Press):

https://www.hup.harvard.edu/books/9780674237841